Advisory on Reporting Values in Table 3.2 of GSTR-3B

🗓️ Date: April 11, 2025

Issued by: GST Network (GSTN)

✅ Key Advisory Update:

- Purpose of Table 3.2 in GSTR-3B

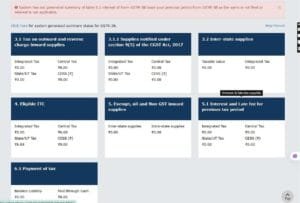

Table 3.2 in Form GSTR-3B is used to report inter-State supplies made to the following categories:- Unregistered Persons (URPs)

- Composition Taxpayers

- UIN Holders

Advisory on Reporting Values in Table 3.2 of GSTR-3B These values are sourced from Table 3.1 and 3.1.1 of GSTR-3B and are auto-populated based on details filed in GSTR-1, GSTR-1A, or IFF.

- Change Effective from April 2025 Tax Period

➤ From April 2025 onwards, the values auto-populated in Table 3.2 of GSTR-3B will be non-editable.

➤ Taxpayers will only be able to file GSTR-3B with the system-generated values. - Amendment Process Going Forward

If there is any mistake or discrepancy in the auto-populated values: Advisory on Reporting Values in Table 3.2 of GSTR-3B- You cannot edit it in GSTR-3B directly.

- You must make corrections via GSTR-1A or by amending the corresponding data in GSTR-1/IFF of the subsequent tax period.

- Advisory for Accurate Filing

To avoid filing errors and ensure compliance:- Report correct inter-state supply details in GSTR-1, GSTR-1A, or IFF.

- The system will then correctly auto-populate Table 3.2 of GSTR-3B.

❓ Frequently Asked Questions (FAQs)

- What changes have been made to Table 3.2 reporting from April 2025?

From April 2025 tax period onwards, Table 3.2 of GSTR-3B becomes non-editable. The values will be auto-filled based on your GSTR-1, GSTR-1A, or IFF submissions and cannot be changed manually.

- How can I fix incorrect values in Table 3.2 of GSTR-3B post-April 2025?

If incorrect details are auto-filled:

- You must amend them in GSTR-1A, or

- Report the corrected figures through GSTR-1/IFF in future tax periods.

- What is the best practice to ensure accurate Table 3.2 auto-fill?

Always verify and report the correct inter-State supplies in GSTR-1, GSTR-1A, or IFF. Accurate reporting ensures error-free auto-population in GSTR-3B.

- What’s the last date to file GSTR-1A before GSTR-3B?

There is no fixed cut-off date for filing GSTR-1A before GSTR-3B. You can file GSTR-1A:

- After submitting GSTR-1, and

- Anytime before filing GSTR-3B for that tax period.

📝 Note: This change aims to enhance data consistency, reduce mismatches, and streamline compliance under GST.

🔍 For more updates, visit: www.gst.gov.in

📌 Stay updated, stay compliant!

– Team GSTN

Let me know if you’d like this adapted into a YouTube video script, email circular, or infographic-style social post!

https://youtu.be/jNdd58IRpio?si=pCE42jK_QlfEoXvt

For More Information : https://taxgyany.com/