Old Tax Regime if Your Company Opted for the New Tax Regime

Understanding the Old and New Tax Regimes

Old Tax Regime if Your Company Opted for the New Tax Regime Taxpayers often face confusion when selecting the most suitable income tax regime. With the introduction of the New Tax Regime as the default option in the Union Budget 2023, individuals must actively choose their preferred tax structure each financial year. The Income Tax Department allows taxpayers to switch between regimes based on their employment status and income type.

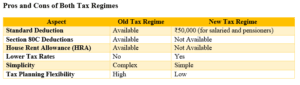

Key Differences Between the Old and New Tax Regimes

The Indian tax system provides two taxation options:

- Old Tax Regime: This system offers multiple deductions and exemptions, allowing taxpayers to lower their taxable income. Old Tax Regime if Your Company Opted for the New Tax Regime Common deductions include Section 80C (Investments in PPF, EPF, LIC, ELSS), House Rent Allowance (HRA), Leave Travel Allowance (LTA), and medical insurance (Section 80D).

- New Tax Regime: Introduced as a simplified tax structure, the New Tax Regime provides lower tax rates but eliminates most deductions and exemptions. It is the default tax option for taxpayers unless they explicitly opt for the Old Regime.

Flexibility in Choosing a Tax Regime

Taxpayers must declare their preferred tax regime while submitting investment proofs to their employer and while filing their Income Tax Return (ITR). Old Tax Regime if Your Company Opted for the New Tax Regime The ability to switch between regimes depends on the taxpayer’s income source:

- Salaried individuals: Have the flexibility to switch every financial year.

- Self-employed/business professionals: Can change only once in a lifetime.

Switching to the Old Tax Regime While Filing ITR

Many taxpayers may find that their employer has deducted tax based on the New Tax Regime, but they wish to claim deductions and exemptions available under the Old Tax Regime. In such cases, taxpayers can switch back while filing their Income Tax Return (ITR).

Steps to Opt-Out of the New Tax Regime

To successfully switch from the New Tax Regime to the Old Tax Regime for Financial Year 2024-25, taxpayers must follow these steps:

- Choose the ‘Old Regime’ option in the ITR form.

- Submit Form 10-IE (mandatory for self-employed professionals and business income earners).Old Tax Regime if Your Company Opted for the New Tax Regime

- Ensure timely filing: Failure to submit Form 10-IE before the ITR due date will result in automatic taxation under the New Tax Regime.

Understanding Form 10-IE

For self-employed individuals or those with business income, switching between tax regimes requires Form 10-IE submission. Key points:

- Must be submitted before filing the ITR.

- Generates a 15-digit acknowledgment number, which must be quoted in the ITR.

- If Form 10-IE is not submitted before the deadline, switching to the Old Tax Regime will not be allowed for that financial year.

Impact of Switching Tax Regimes

Switching between tax regimes can have significant financial implications. Old Tax Regime if Your Company Opted for the New Tax Regime It is essential to evaluate the tax benefits associated with each regime before making a decision.

When to Choose the Old Tax Regime?

- If you claim multiple deductions under Sections 80C, 80D, 24(b) (home loan interest), and HRA.

- If you have significant tax-saving investments and expenses.

- If deductions and exemptions significantly reduce your taxable income.

When to Choose the New Tax Regime?

- If you prefer a simplified tax structure with lower tax rates.

- If you do not have many deductions to claim.

- Old Tax Regime if Your Company Opted for the New Tax Regime If your total taxable income remains lower under the new tax regime despite the absence of deductions.

How to Make an Informed Decision?

Taxpayers should perform a break-even analysis to determine which regime is more beneficial. Key considerations include:

- Total income and applicable tax slabs.

- Eligible deductions and exemptions.

- Projected tax liability under both regimes.

To calculate the best regime, use an income tax calculator or consult a tax professional.

Conclusion

The ability to switch tax regimes provides flexibility, but taxpayers must adhere to compliance requirements. Old Tax Regime if Your Company Opted for the New Tax Regime Salaried individuals can switch regimes annually, while self-employed individuals can change only once. To ensure a smooth transition to the Old Tax Regime, timely submission of Form 10-IE and careful financial planning are essential.

Before making a final decision, assess your tax-saving investments, eligible deductions, and financial objectives to optimize your tax liability. Choosing the right regime can help minimize taxes and maximize savings in the long run.

Sources Link – https://shorturl.at/4AE3J

For More Information : https://taxgyany.com/

This blog explains the step-by-step process to switch to the old tax regime if your company has opted for the new one in 2025. A must-read for effective tax planning!