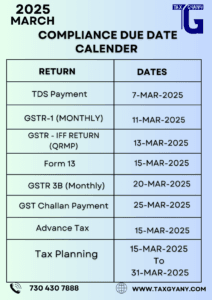

Compliance Calendar for March 2025

Compliance Calendar for March 2025 As we step into March 2025, businesses and individuals need to stay updated on crucial tax and GST compliance deadlines. Compliance Calendar for March 2025 Missing these deadlines can lead to penalties, interest, or legal consequences.

This compliance calendar highlights key dates for TDS payments, GST returns, advance tax, and tax planning to help taxpayers meet their obligations on time.

TDS Payment Deadlines

Timely payment of Tax Deducted at Source (TDS) ensures compliance with income tax regulations. The due dates for different TDS payments in March 2025 are as follows:

(a) TDS Payment for Property, Rent, Contractor Payments & Crypto Assets

- Due Date: 02-03-2025

- Forms: 26QB (Property), 26QC (Rent), 26QD (Contractor Payments), 26QE (Crypto Assets)

- Details: TDS deducted for January 2025 must be deposited by this date to avoid interest and penalties.

(b) TDS Payment for the Previous Month

- Due Date: 07-03-2025

- Details: Compliance Calendar for March 2025 General TDS deductions for February 2025 must be deposited by this date. This applies to businesses and entities required to deduct tax at source on payments such as salaries, professional fees, commission, and rent.

(c) TDS Payment for Property, Rent, Contractor Payments & Crypto Assets for February 2025

- Due Date: 30-03-2025

- Forms: 26QB, 26QC, 26QD, 26QE

- Details: TDS deducted in February 2025 for property, rent, contractor payments, and crypto transactions must be deposited by this date.

GST Return Filing Deadlines

GST taxpayers must file their returns on time to comply with tax laws and claim input tax credit (ITC). Compliance Calendar for March 2025 The key GST return deadlines in March 2025 include:

(a) GSTR-1 (Monthly Filers)

- Due Date: 11-03-2025

- Details: Taxpayers with a turnover of more than ₹5 crore must file GSTR-1 for February 2025, reporting all outward supplies.

(b) GSTR IFF (QRMP Taxpayers)

- Due Date: 13-03-2025

- Details: QRMP scheme taxpayers need to file their Invoice Furnishing Facility (IFF) for February 2025 to report B2B transactions.

(c) GSTR-3B (Monthly Filers)

- Due Date: 20-03-2025

- Details: GSTR-3B for February 2025 must be filed by businesses that opt for monthly GST filing. It summarizes tax liabilities and ITC claims.

(d) GST Challan Payment for Quarterly Filers

- Due Date: 25-03-2025

- Details: Businesses under the QRMP scheme must pay GST if their ITC is insufficient for February 2025.

Advance Tax Payment for Q4 FY 2024-25

- Due Date: 15-03-2025

- Details: Advance tax for the quarter January to March 2025 must be paid by individuals and businesses whose total tax liability exceeds ₹10,000 per year.

- Form 13 (Nil / Lower TDS Certificate) for FY 2024-25

- Due Date: 15-03-2025

- Details: Taxpayers who wish to apply for Nil or lower TDS deduction for FY 2024-25 must submit Form 13 by this date.

- Tax Planning & Book Closure for FY 2024-25

- Due Date: 15-03-2025

- Details: This is the last month of the financial year, making it crucial for tax planning, maximizing deductions, and closing books of accounts to ensure accurate filings in April.

Final Thoughts

Staying compliant with tax and GST deadlines is essential to avoid penalties and ensure smooth financial operations. Compliance Calendar for March 2025 Mark your calendar for these important dates in March 2025 to manage tax payments efficiently. If you need assistance with tax planning, TDS filings, or GST compliance, consult a tax professional or use automation tools for timely submissions.

📌 Stay updated with the latest tax and GST changes by following our blog!

For More Information : https://taxgyany.com/

Heⅼlo to all, how iѕ all, I think every one is getting more from this web page, and yߋur viewѕ are fastidious for new users.

Have you ever thought about adding a little bit more than just your articles?

I mean, what you say is fundamental and everything. Nevertheless think of if you added some great graphics or video clips to

give your posts more, “pop”! Your content is excellent but with pics and video clips, this website could certainly be

one of the very best in its niche. Amazing blog!

I’m not sure where you’re getting your information, but great topic.

I needs to spend some time learning much more or understanding more.

Thanks for fantastic information I was looking for this information for

my mission.

Hi! I’m at ᴡorҝ suгfing aroᥙnd your blog from my new iphone 4!

Just wanted to ѕay I love reading yoսr blog and look

foгward to all your posts! Keep up the outstanding work!

You really make it seem so easy with your presentation butt I find this matter to be really something which

I thnk I would never understand. It seems too complex and extremely

broad for me. I am looking forward for your nex post, I

will try to get the hang of it! http://Boyarka-inform.com/