ITR Due Date Extended from 31st July to 15th September: What It Means for You

What Is the New ITR Due Date?

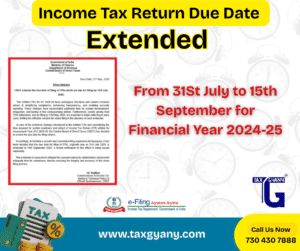

The Income Tax Department has announced that the due date for filing ITR for the financial year 2024–2025 (assessment year 2025–2026) has been extended from:

📆 31st July 2025 ➜ 15th September 2025

This applies mainly to:

Salaried individuals

Professionals and freelancers

Small business owners who are not required to get their books audited

Why Was the Due Date Extended?

There could be many reasons behind the extension, including:

Technical issues or delays in the income tax portal

Requests from taxpayers or tax professionals for more time

To ensure proper filing and reduce last-minute panic

Recent changes in forms, procedures, or tax laws

The government wants to ensure a smooth and stress-free filing process for all taxpayers.

Who Benefits From This Extension?

Here’s a quick look at the types of taxpayers who benefit:

✅ Salaried employees – You now have extra time to collect Form 16 and other documents

✅ Freelancers and professionals – More time to calculate income and expenses

✅ Small business owners (non-audit cases) – Avoid unnecessary penalties

✅ Senior citizens – Better time to consult tax advisors

✅ First-time filers – Understand the process without pressure

What You Should Do With This Extra Time

Just because the deadline is extended doesn’t mean you should delay. Use this time wisely.

✔️ Gather All Your Documents:

Form 16 from your employer

Interest certificates from banks

Form 26AS and AIS from the income tax portal

Rent receipts, donation receipts, etc.

✔️ Check PAN-Aadhaar Linking:

Ensure your PAN is linked with Aadhaar. Without this, your return can’t be processed.

✔️ Choose Correct ITR Form:

There are different ITR forms based on income type. Don’t guess—use the correct one.

✔️ Pre-Validate Bank Account:

This is needed to receive any refund directly to your account.

✔️ File Early and Relax:

Avoid portal overload and last-minute technical issues.

What Happens If You Still Miss the Deadline?

Even though the new due date is 15th September 2025, don’t assume it can be skipped. Here’s what could happen if you miss the new deadline:

🚫 Late filing fee up to ₹5,000 under Section 234F

🚫 Interest on unpaid tax under Sections 234A, 234B, and 234C

🚫 Losses (like capital loss or business loss) can’t be carried forward

🚫 Refunds get delayed

Don’t Confuse Extension With Exemption

Many people confuse an extended deadline with an exemption from filing. That’s not true. If your income is above the basic exemption limit:

₹2.5 lakh (general)

₹3 lakh (senior citizen)

₹5 lakh (super senior citizen)

…you must file your ITR, even with the extension.

✅ Key Takeaways:

New ITR Due Date: 15th September 2025

Applies to: Salaried, freelancers, and non-audit taxpayers

Use the time to gather documents, verify details, and avoid last-minute panic

Don’t forget to link PAN with Aadhaar

If you want help in filing your ITR smoothly, talk to TAXGYANY. Happy Filing!