Who Needs to File ITR for FY 2024-25 (AY 2025-26)? Know Before the Deadline!

The new financial year is already ticking away, and the Income Tax Return (ITR) filing season is just around the corner. Whether you’re a salaried employee, business owner, freelancer, or NRI — it’s time to ask yourself an important question:

“Am I required to file an ITR this year?”

Let’s understand who must file an ITR for Financial Year 2024-25 (Assessment Year 2025-26), based on the latest income tax rules.

📌 Why Filing ITR Is Important

Before we jump into the eligibility, let’s understand why ITR filing matters:

- ✅ It is mandatory for those meeting the conditions set by the Income Tax Department.

- ✅ It helps you claim refunds on excess TDS deducted.

- ✅ It’s essential for applying for visas, loans, and government tenders.

- ✅ It shows your financial discipline and improves credibility.

👥 Who Must File ITR? (Basic Conditions)

1️⃣ If Your Income Exceeds the Exemption Limit

Here are the current tax-free income limits:

| Age Group | Income Limit |

|---|---|

| Below 60 years | ₹2.5 lakhs |

| 60 to 79 years | ₹3 lakhs |

| 80 years and above | ₹5 lakhs |

If your total annual income (before deductions) crosses these limits, you must file an ITR.

💰 Other Situations Where ITR Filing Is Mandatory

Even if your income is below the exemption limit, you still need to file an ITR if:

2️⃣ You Want to Claim an Income Tax Refund

If TDS (Tax Deducted at Source) was cut from your salary or bank interest and your actual tax liability is less or zero — you must file an ITR to get a refund.

3️⃣ You Have Foreign Income or Assets

If you own foreign shares, bank accounts, properties, or earned income abroad (but taxable in India), you are mandatorily required to file an ITR.

4️⃣ You Want to Apply for a Visa or Loan

Many embassies and banks ask for your ITR copies to evaluate your financial standing. If you plan to apply for a home loan, car loan, or travel visa, file your ITR without fail.

5️⃣ You Are a Company or a Firm

If you run a registered company or partnership firm, you must file your ITR every year, even if you have made no profit or loss.

🔁 File ITR to Carry Forward Losses

Did you suffer a business loss or a capital loss from shares?

You can carry forward such losses to future years only if you file your ITR before the due date. Delayed filing = loss of carry-forward benefit.

⚠️ High-Value Transactions? You Must File

Even if you’re not crossing the basic exemption, you are required to file ITR if you meet any of the following conditions:

- 💳 Deposited ₹1 crore or more in one or more current accounts

- 🏦 Deposited over ₹50 lakhs in savings accounts

- ✈️ Spent ₹2 lakhs or more on foreign travel

- 💡 Paid electricity bill of ₹1 lakh or more

- 💸 TDS/TCS of ₹25,000 or more (₹50,000 for senior citizens)

- 📈 Business turnover > ₹60 lakhs

- 💼 Professional income > ₹10 lakhs

- 🧾 Aggregate TDS + TCS ≥ ₹25,000

These are considered “significant transactions” and are tracked by the Income Tax Department. Failing to file ITR in these cases may attract notices or scrutiny.

🌏 Income Tax Filing for NRIs

Are you a Non-Resident Indian (NRI)?

Here’s what you need to know:

- If your Indian income exceeds ₹2.5 lakhs, you must file ITR in India.

- NRIs cannot claim basic exemption against capital gains (like residents can).

- Hence, even ₹1 of capital gain may mean you need to file an ITR.

💻 Why File ITR Online?

E-filing is now the standard and preferred way:

- 📥 Easy, quick, and paperless

- 🔐 Secure & trackable

- 📄 Instant proof with acknowledgement

- 👵 Senior citizens (above 80 years) can file paper returns if no business/professional income

⛔ Penalties for Late or Non-Filing

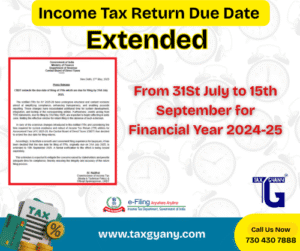

- 🕒 Deadline for filing ITR: 31st July 2025

- ❌ If filed after that:

- ₹5,000 penalty

- ₹1,000 if your income is below ₹5 lakhs

- 💰 Interest on late taxes, loss of refund claim, and scrutiny risk

📝 Final Checklist: Do You Need to File ITR This Year?

✅ Income exceeds basic limit

✅ Want a tax refund

✅ Foreign assets/income

✅ TDS > ₹25,000

✅ High-value deposits or spending

✅ Carry forward losses

✅ NRI with Indian capital gains

✅ Applying for loan or visa

🧠 Conclusion: Don’t Miss Out, File Smartly

Filing your ITR isn’t just about tax. It’s about staying safe, building credibility, and avoiding unnecessary legal trouble. Whether you’re salaried, self-employed, a student, or an NRI — know your status and file on time.

Need help filing your return?

TAXGYANY’s expert team is here to guide you every step of the way. Visit www.taxgyany.com or call us now!

sources- https://cleartax.in/s/are-you-required-to-file-an-income-tax-return-for-ay-2023-24-fy-2022-23

#ITR2025 #IncomeTaxReturn #WhoShouldFileITR #ITRFilingIndia #NRIITR #ITRDeadline #Taxgyany #TaxAwareness #FilingSeason2025

Nice article. I understood. Good read.