Why You Must Validate Your Bank Account to Get Your Income Tax Refund

Rita’s Refund Was Stuck – Here’s Why

Rita, a salaried professional from Mumbai, had been eagerly waiting for her income tax refund for months. She had filed her ITR on time, checked all details, and was expecting the refund to hit her account soon. But week after week passed, and still—nothing.

Worried, she logged into the income tax portal to track her refund status. That’s when she saw the reason: “Bank Account Not Validated.”

Even though she had entered the correct account details while filing her return, she forgot to validate it on the portal.

A simple step—but it cost her weeks of delay.

Don’t be like Rita. Let’s understand what bank account validation means, why it matters, and how you can do it in just a few clicks.

✅ What Is Bank Account Validation in Income Tax Portal?

Before the Income Tax Department sends your refund, it needs to make sure your bank account:

- Is active

- Belongs to you

- Is ready to receive the refund

This process is called bank account validation. It’s a simple verification where the portal checks your account details with your bank via NPCI (National Payments Corporation of India).

🔍 Why Is Bank Validation Mandatory?

If your bank account is not validated, your ITR refund:

- Won’t be processed

- Or worse, might bounce back

As per the latest income tax rules, refunds are issued only to pre-validated accounts linked to your PAN and verified on the income tax portal.

So, even if your return is perfectly filed, your refund will be held up if this step is missed.

💡 Steps to Validate Your Bank Account

You can validate your bank account on the Income Tax portal in just a few minutes. Here’s how:

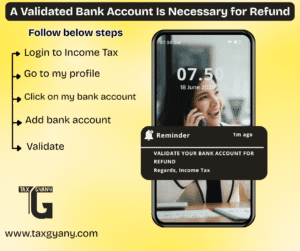

📲 Step-by-Step Guide:

- Login to https://www.incometax.gov.in

- Go to ‘My Profile’

- Click on ‘My Bank Account’

- Click ‘Add Bank Account’ if not already listed

- Enter your Bank Name, Account Number, IFSC Code, and Mobile Number linked with the bank

- Click on ‘Validate’

Once submitted, the portal will show the status:

- ✔️ Validated: Account is ready for refund

- ⏳ Pending: Still being verified

- ❌ Failed: Re-check your bank details

📌 Tips to Ensure Smooth Bank Validation

To avoid issues during validation, follow these tips:

- ✅ Use an account in your own name (must match PAN holder)

- ✅ Ensure the mobile number is linked to the bank account

- ✅ Double-check the IFSC code and account number

- ✅ Avoid joint accounts or inactive accounts

🚨 What Happens If You Don’t Validate?

Let’s be honest—many taxpayers don’t even realize this step exists until they face refund delays. Here’s what can happen if your bank account isn’t validated:

- ⛔ Refund gets stuck or delayed indefinitely

- 🔁 You may have to file a revalidation request later

- 🕒 Processing time for your refund increases

- ❌ You may miss your refund completely if deadlines lapse

🧾 Can You Add Multiple Bank Accounts?

Yes, the portal allows you to add multiple accounts, but only one can be set as “Refund Account.” This is the account where your refund will be credited.

You can change your refund account later too, but ensure the new one is validated before making the change.

🧠 Who Should Do This?

- ✅ Salaried employees filing ITR

- ✅ Freelancers and consultants expecting refunds

- ✅ Business owners registered under PAN

- ✅ Senior citizens filing returns for interest income

- ✅ NRIs with valid Indian bank accounts

In short: Everyone who’s filing ITR and expects a refund.

📚 Summary – Bank Validation in One Glance

| Action | Details |

|---|---|

| What | Verifying your bank account with IT portal |

| Why | Mandatory to receive refunds |

| How | Through ‘My Profile’ > ‘My Bank Account’ |

| Who | All taxpayers expecting refunds |

| When | Preferably before filing ITR or immediately after |

✅ Conclusion: Don’t Delay Your Refund – Validate Today

Your refund is your money — and you deserve to receive it quickly and smoothly. Don’t let something as simple as bank account validation become the reason for delay or denial.

Take a few minutes, login to the portal, and complete this process. Just like Rita eventually did — and her refund reached her account within days.

🌟 Moral of the Story: Small Steps Avoid Big Delays

Rita’s story reminds us that in tax filing, every small detail matters. Filing your return is just part of the job—ensuring refund processing needs a validated bank account.

So, before you sit back thinking “Done with ITR,” ask yourself:

👉 “Have I validated my bank account yet?”

Need help with ITR filing or refund tracking?

Visit www.taxgyany.com or call our expert team today.

source – https://eportal.incometax.gov.in/iec/foservices/#/login

#IncomeTaxRefund #BankValidation #ITR2025 #Taxgyany #TaxTips #RefundUpdate #TaxSeasonReady #ValidateYourBank #IncomeTaxIndia #ITRFilingMadeEasy