Table of Contents

ToggleFile Your Pending GST Returns Before It’s Too Late: New 3-Year Rule Starts August 2025

Ramesh’s GST Wake-Up Call

Ramesh owns a small electronics store in Pune. During COVID-19, his business struggled, and like many small traders, he missed filing a few GST returns. He thought he would catch up later and assumed the portal would always be open.

Fast forward to July 2025 — Ramesh finally decided to clean up his GST records. But when he tried to file his GSTR-3B for June 2022, he got a rude shock: “Return filing is barred due to expiry of 3-year limit.”

He didn’t know that a new rule would block GST return filings after 3 years from the original due date. That delay could now cost him penalties, ITC losses, and possible legal action.

📢 What’s the New GST Filing Rule?

As per Finance Act, 2023, and Notification No. 28/2023 – Central Tax, from 1st August 2025, GST returns cannot be filed after three years from their original due date.

This restriction applies to all major GST return forms, including:

GSTR-1 / IFF (Outward Supplies)

GSTR-3B (Summary Return & Tax Payment)

GSTR-4 (Composition Scheme Return)

GSTR-5, 5A (for non-resident & OIDAR)

GSTR-6 (ISD return)

GSTR-7, 8 (TDS/TCS)

GSTR-9, 9C (Annual Return and Reconciliation)

So if you haven’t filed any of these returns within 3 years, you won’t be allowed to file them after July 31, 2025 — no matter the reason.

🗓️ What Periods Will Be Barred First?

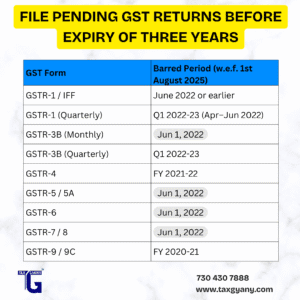

Here’s a snapshot of the first set of returns that will be barred from 1st August 2025:

| GST Form | Barred From Filing If Pending For |

|---|---|

| GSTR-1 / IFF | June 2022 or earlier |

| GSTR-1 (Quarterly) | Q1 2022-23 (Apr–Jun 2022) |

| GSTR-3B (Monthly) | June 2022 |

| GSTR-3B (Quarterly) | Q1 2022-23 |

| GSTR-4 | FY 2021-22 |

| GSTR-5 / 5A | June 2022 |

| GSTR-6 | June 2022 |

| GSTR-7 / 8 | June 2022 |

| GSTR-9 / 9C | FY 2020-21 |

If you haven’t filed any of the above returns — do it NOW, or you’ll lose the window permanently.

❗ Why This Rule Matters

This rule isn’t just a technical update — it has real consequences for taxpayers:

🔴 Risks of Ignoring This:

❌ Loss of Input Tax Credit (ITC)

⚠️ Notices or scrutiny from the department

💸 Penalties and late fees

🔒 Risk of cancellation of GST registration

🧾 Mismatched records in Annual Return and audits

🚫 Difficulty applying for loans, tenders, or refunds

Filing on time isn’t just about compliance — it keeps your business records clean and helps avoid unnecessary stress.

✅ What You Should Do Now

If you have old returns pending — act immediately. Here’s a simple checklist:

📋 Steps to File Before the 3-Year Deadline:

Login to GST Portal

Go to Dashboard > Returns > File Returns

Check for any pending GSTR-1, 3B, 4, etc.

Reconcile your sales, purchases, ITC, and tax paid

File each pending return before 31st July 2025

💡 Important Tips for Taxpayers

🔎 Reconcile data with your books, invoices, and GSTR-2B

🧾 Clear any tax liabilities or interest before filing

📁 Consult your CA or tax expert if you’re unsure

🔁 Avoid waiting till the last day — the portal may be busy

👨💼 Who Is Affected Most?

📦 Small and medium traders who missed returns during pandemic

🧳 Transporters, freelancers, and businesses with part-time compliance

🌍 NRIs or OIDAR service providers with missed GSTR-5 / 5A

📉 Businesses facing cash crunch who delayed tax payments

If you fall into any of these categories — review your filing history today.

🔚 Conclusion: Don’t Let 3 Years Become 3 Regrets

The 3-year window is closing soon. Once gone, there’s no second chance. If you’ve been putting off GST compliance, now is the time to act.

Learn from Ramesh’s mistake — don’t wait for the last minute and lose your chance to file.

🌟 Moral of the Story: File Late, But Don’t Miss the Gate

Even if you’re behind on your returns, the window is still open. But not for long.

File now. Stay clean. Keep your business future-ready.

Need help catching up on your pending GST returns?

Get in touch with Team Taxgyany at www.taxgyany.com for expert guidance.

#GSTUpdate #FileBeforeDeadline #GSTReturns2025 #GSTCompliance #GSTR3B #GSTR1 #PendingReturns #3YearRule #Taxgyany #BusinessCompliance #GSTIndia

SOURCES – https://www.gst.gov.in/newsandupdates/read/612