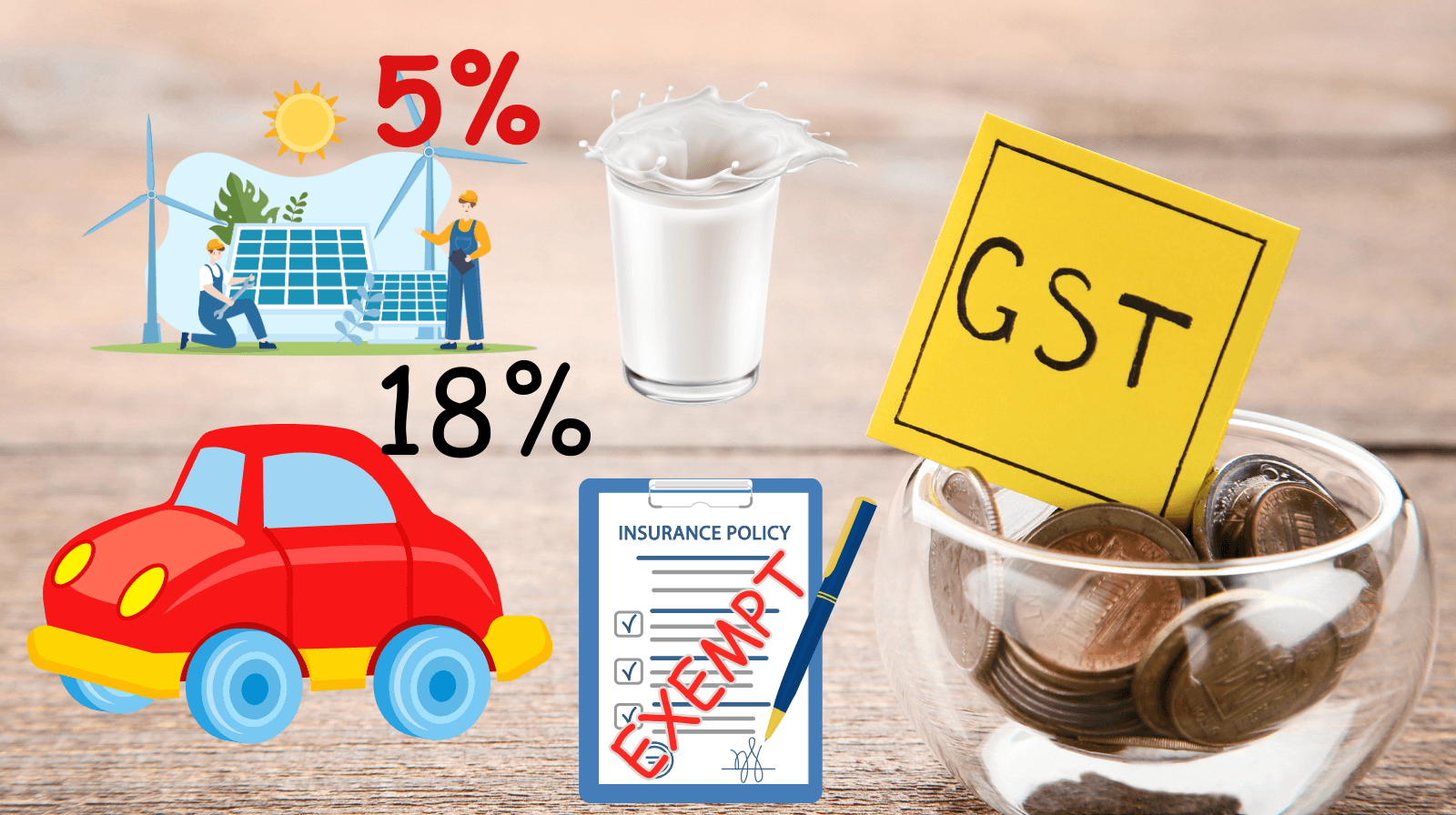

56th GST Council Meeting: Key Changes in GST Rates Effective from September 22, 2025

The 56th GST Council Meeting, chaired by Union Finance Minister, has introduced a wide range of changes in GST rates on goods and services, effective September 22, 2025. These reforms aim to simplify the tax structure, reduce compliance burden, and bring relief to businesses and consumers. Let’s take a detailed look at what has changed.

📅 Effective Date of New GST Rates

The new GST rates will be applicable from 22nd September 2025.

Exceptions: Goods like pan masala, cigarettes, chewing tobacco, zarda, unmanufactured tobacco, and beedi will continue with existing rates until the compensation cess loan and interest liabilities are cleared.

🔑 Major Highlights from the 56th GST Council Meeting

1️⃣ GST Exemption on Life & Health Insurance

Life insurance (term, ULIP, endowment) and health insurance (family floater, senior citizen plans) are now exempt from GST.

Earlier, these policies attracted 18% GST. For example, a premium of ₹20,000 used to include ₹3,600 GST. Now, the base premium only will be payable.

Impact: Insurance premiums will become more affordable for households, though insurers have raised concerns about losing Input Tax Credit (ITC). Experts recommend making these services “zero-rated” instead of exempt, to allow insurers to claim ITC while giving relief to customers.

2️⃣ GST Rate Cuts on Daily Essentials

UHT Milk: Now exempt, aligning with other dairy milk.

Plant-based milk & soya milk drinks: Reduced from 18%/12% to 5%.

Toilet soap bars: Reduced from 18% to 5%, easing household budgets.

Face powder & shampoos: Reduced to 5%, benefiting common consumers.

Dental products (toothpaste, toothbrush, floss): Reduced to 5%.

3️⃣ GST Relief for Farmers & Healthcare

Agriculture machinery: Reduced from 12% to 5%, including sprinklers, irrigation systems, and harvesting equipment.

Medical devices: Reduced to 5% from earlier higher slabs.

Medicines: Concessional GST of 5% continues (instead of full exemption to avoid ITC break).

4️⃣ Big Relief in Auto & Transport Sector

Small cars (petrol/diesel, under 4000 mm length): GST reduced from 28% to 18%.

Three-wheelers: Reduced to 18% from 28%.

Buses & trucks: Reduced to 18% from 28%.

Motorcycles up to 350cc: 18% GST; above 350cc – 40%.

Mid & large cars, SUVs, MUVs: Now taxed at 40% (no cess), replacing earlier 28% + cess (45–50% total).

5️⃣ Renewable Energy & Green Push

Renewable energy equipment/devices: Reduced from 12% to 5%.

Encourages adoption of solar, wind, and green technologies.

6️⃣ Other Important Changes

Bicycles & parts: Reduced from 12% to 5%.

Marble, granite, travertine blocks: Reduced to 5%.

Spectacles & corrective goggles: Now 5% (reduced from 12–18%).

Air conditioners, dishwashers, TVs/monitors: Unified at 18% (earlier 28%).

GTA Services: Option of 5% (no ITC) or 18% (with ITC).

Beauty & wellness services (salons, gyms, yoga, spas): Reduced from 18% to 5% (no ITC).

Casinos, betting, online gaming, horse racing, lotteries: Attract 40% GST.

📌 What This Means for You

Consumers: Lower costs on essentials, insurance, small cars, medicines, and appliances.

Businesses: Must adapt accounting for ITC reversals and revised GST rates from 22nd September 2025.

Insurance & Healthcare: Expect more demand due to affordability, but backend costs may increase.

📞 Need Help with GST Compliance?

The new GST rates bring both opportunities and challenges. Businesses must carefully update billing systems, ITC claims, and pricing strategies to stay compliant.

👉 At TaxGyany, we provide end-to-end support for:

GST Registration & Return Filing

GST Appeals & Notices Handling

GST Advisory for Businesses

📍 Contact Us Today

🌐 Website: www.taxgyany.com

📧 Email: info@taxgyany.com

📞 Call: +91 730 430 7888

Stay compliant, stay ahead with TaxGyany – Your Trusted Tax Partner.