Can My Client Claim Input Tax Credit (ITC) on Construction of Conventional Hall?

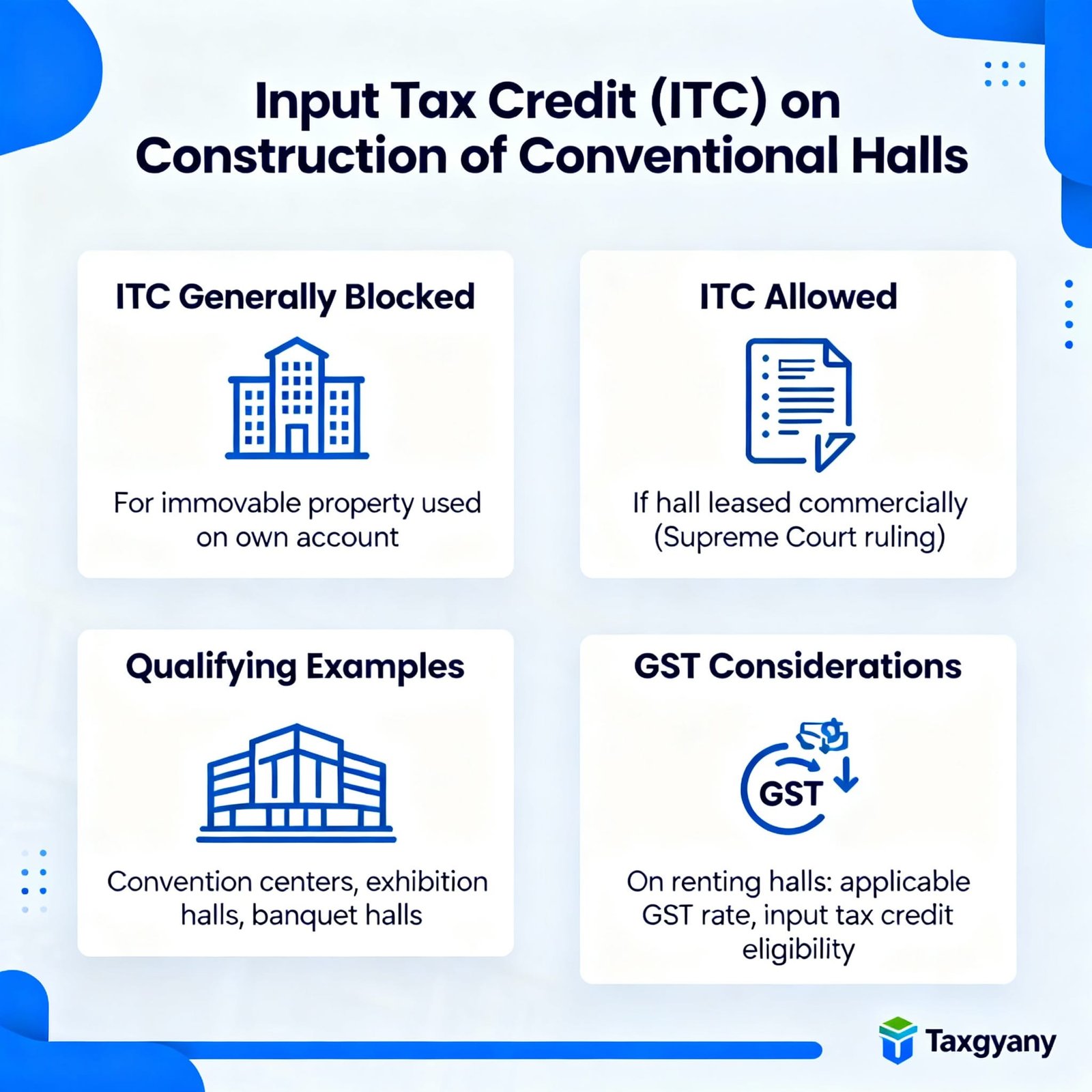

When clients invest in constructing a conventional hall, a common question arises: Is the GST paid on construction eligible as Input Tax Credit (ITC)? The answer is nuanced and depends on several factors under GST law and recent Supreme Court rulings in India.

GST and Input Tax Credit Basics

Input Tax Credit allows businesses to reduce the tax they pay on sales by the GST already paid on purchases related to their business. However, Section 17(5)(c) and 17(5)(d) of the CGST Act restrict ITC for goods and services or both used for construction of immovable property, except for plant and machinery.

Simply put, if construction is for immovable property on your own account, ITC is generally blocked.

What About Construction of a Conventional Hall?

A conventional hall is usually an immovable property and would typically fall under blocked ITC as per Section 17(5)(d). This means:

If your client constructed the hall for their own use or own account, ITC is not available on GST paid on inputs like building materials, labour, and services.

However, if the hall is constructed for the purpose of commercial renting/leasing – that is, your client plans to lease or rent out the hall commercially, recent Supreme Court rulings allow ITC on construction costs, treating the building as “plant” essential for rendering the service of renting.

Key Supreme Court Ruling Impacting ITC on Construction

In October 2024, the Supreme Court of India ruled in the case of Safari Retreats Pvt. Ltd. that:

A building constructed for commercial leasing or renting out cannot be considered as constructed on one’s own account.

Such buildings qualify as “plant” under section 17(5)(d) of the CGST Act.

Consequently, ITC shall be available on GST paid for construction of such commercial buildings except hotels or cinema theatres.

The “functionality test” will be applied case-by-case to check if the building qualifies as “plant.”

Practical Takeaways for Your Client

If your client constructed the conventional hall to rent out commercially, claiming ITC on GST paid for construction may be possible following the Supreme Court’s ruling.

If the hall is for own use (like internal business use, events only for own company), ITC will likely be blocked.

Detailed documentation and compliance with GST rules are critical to justify the claim.

Advance ruling from GST authorities may be considered for clarity on complex cases.

Other GST Considerations for Conventional Halls

Renting out a conventional hall is considered a taxable supply of service under GST.

Your client must charge GST on rental income at appropriate rates.

ITC is available on GST paid on purchases related directly to this rental service.

Composite services including catering and decoration in the hall are also taxable at GST.

Conclusion

Claiming GST Input Tax Credit on construction of a conventional hall depends mainly on the purpose:

For commercial lease or rent: ITC is allowed as the hall is considered a “plant” for commercial services.

For own use: ITC is generally blocked on construction costs.

Clients should evaluate their usage and plan GST compliances accordingly, preferably with professional guidance.

For expert advice tailored to your specific case, contact Taxgyany at 7304307888 or visit www.taxgyany.com.