Annual Aggregate Turnover

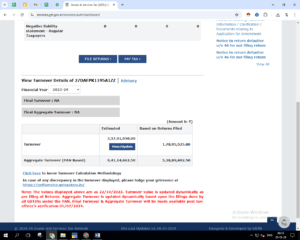

Annual Aggregate Turnover (AATO) refers to the total turnover of a business calculated for an entire financial year, from April 1st of one year to March 31st of the following year. Annual Aggregate Turnover It is a critical concept under the Goods and Services Tax (GST) regime and includes various components of turnover to assess compliance requirements and eligibility for certain schemes.

Purpose of Calculating AATO

AATO serves as a benchmark for several GST-related compliances. It is used to determine:

- Threshold Limit for GST Registration

Businesses must register for GST if their AATO exceeds the prescribed threshold limit (₹20 lakhs for special category states and ₹40 lakhs for others in most cases). - Eligibility for the Composition Scheme

Annual Aggregate Turnover The composition scheme allows small taxpayers to pay GST at a lower rate. AATO helps verify if a business qualifies for this scheme (threshold limit: ₹1.5 crore in most states). - Annual Return and GST Audit Requirements

Businesses with AATO exceeding ₹2 crore must file an annual return and may require a GST audit by a Chartered Accountant or Cost Accountant.

Components of Annual Aggregate Turnover (AATO)

AATO includes the total turnover at the PAN level, combining all GST Identification Numbers (GSTINs) registered under the same PAN. It comprises the following:

- Taxable Sales Value

The value of goods and services that attract GST. - Exempt Sales Value

Turnover from goods or services that are exempt from GST. - Export of Goods and Services

Exports are zero-rated under GST but are still included in AATO. - Interstate Supplies to Sister Concerns

Supplies made to branches or sister concerns under the same PAN across different states. - Interstate Stock Transfers

Transfers of stock between branches in different states under the same PAN.

How to Calculate AATO?

Example 1: AATO for Normal Category States

Mr. A owns a tea estate and sells tea leaves with an annual turnover of ₹1.6 crore. Selling tea leaves is an exempt supply under GST. Additionally, Mr. A sells plastic bags worth ₹5 lakhs, which is a taxable supply.

Calculation:

- Exempt supply turnover = ₹1.6 crore

- Taxable supply turnover = ₹5 lakhs

Annual Aggregate Turnover = ₹1.6 crore + ₹5 lakhs = ₹1.65 crore

Implications:

- Since Mr. A’s AATO exceeds ₹40 lakhs, he must register under GST.

- He cannot opt for the composition scheme as his AATO exceeds the threshold of ₹1.5 crore.

AATO and Its Role in GST Compliance

Key References in GST Law

| Compliance | Threshold Limit Considered |

| Normal GST Registration | AATO in the current financial year |

| Composition Scheme Registration | AATO in the previous financial year |

| Applicability of E-Invoicing | AATO in any financial year since FY 2017-18 |

| GST Audit by CA/CMA | AATO in the current financial year |

| Eligibility for QRMP Scheme | AATO in the previous financial year |

| Mandatory HSN Code Reporting | AATO in the previous financial year |

| Tax Rate in Composition Scheme | Turnover in the state |

Conclusion

Understanding AATO is essential for businesses to ensure GST compliance, determine eligibility for schemes, and avoid penalties. Businesses should carefully calculate AATO by including all taxable, exempt, export, and inter-branch transactions to meet their legal obligations effectively.

https://youtu.be/FYNFQG_-HRQ?si=K9hxaQSktHKQXuKR

For More Information : https://taxgyany.com/