Archival of GST Returns Data on the GST Portal

Archival of GST Returns Data on the GST Portal The Goods and Services Tax (GST) portal has implemented a new data archival policy, which taxpayers must be aware of to ensure compliance and maintain access to their return filings. As of September 24, 2024, two important updates impact the filing and retrieval of GST returns.

Key Updates on the Archival of GST Returns Data

Under Section 39(11) of the CGST Act, 2017, effective from October 1, 2023, as per Notification No. 28/2023 – Central Tax dated July 31, 2023, taxpayers are no longer allowed to file GST returns after the expiry of three years from the due date. Archival of GST Returns Data on the GST Portal This means that if the filing window closes after three years, taxpayers will be permanently blocked from submitting their returns for that period. This change emphasizes timely compliance to avoid penalties or legal complications.

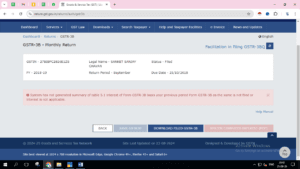

In addition to the filing restriction, the GST portal’s data retention policy has also been revised. The portal will only retain GST return data for seven years. Any return older than seven years will no longer be available for viewing or downloading through the portal.

For example:

- On August 1, 2024, return data for July 2017 was archived and removed from the portal.

- On September 1, 2024, data for August 2017 was also archived. This process will continue each month, with September 2017 returns being archived on October 1, 2024, and so on.

What Taxpayers Need to Do

It is crucial for businesses to download and securely store any GST returns older than seven years, as these will no longer be accessible on the GST portal. Archival of GST Returns Data on the GST Portal The data archival will happen monthly, so taxpayers must be vigilant about keeping their financial records up to date.

Why You Should Act Now

Failure to download archived data may result in difficulties during audits, financial assessments, or compliance reviews. Once data is archived, it will no longer be available on the GST portal, and accessing it through other means could prove costly and time-consuming.

How to Download Old GST Return Data (Step-by-Step Guide)

Follow these steps to ensure you download and store your GST returns data before it is archived:

Log in to the GST Portal:

Visit the GST portal at gst.gov.in and log in with your credentials.

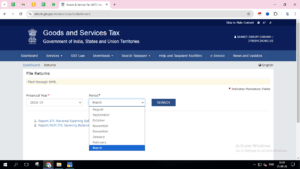

Go to the ‘Returns Dashboard’:

After logging in, navigate to the ‘Returns’ section under the ‘Services’ Select

‘Returns Dashboard’ from the dropdown

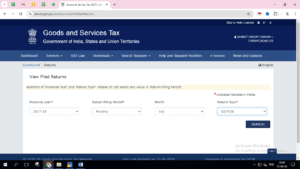

Choose the Financial Year:

Select the financial year and return period you wish to access.

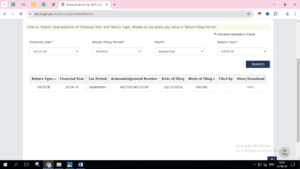

Download the Returns:

Click on the ‘Download’ button to save the return in your preferred format.

- Backup the Data:

Store the downloaded files securely on your device and create a backup on external drives or cloud storage.

Conclusion

With the new GST archival policy, businesses must adopt a proactive approach to ensure they have copies of all relevant data for future reference. Download your historical GST returns before the seven-year limit to avoid losing access to important records. Archival of GST Returns Data on the GST Portal Timely compliance and regular data backups are critical to maintaining a seamless GST filing process.

For More Information :https://taxgyany.com/

Check out YouTube Channel : https://youtu.be/hulXmS-Jn2I?si=gsihNZ2wKPAtytQl