August 2025 Compliance Calendar for Businesses – Don’t Miss These Tax Deadlines!

Running a business means staying compliant with monthly tax obligations. Missing any due date can lead to interest, penalties, or unnecessary hassles. That’s why we’ve created this easy-to-follow guide to your August 2025 Tax Compliance Calendar, based on the latest deadlines from the Income Tax and GST departments.

Let’s walk you through the key filings and payment dates for August 2025!

✅ 1. TDS Payment – Due by 7th August 2025

What to Do: Deposit the TDS deducted in July 2025

Applies To: Businesses, Companies, Professionals who deduct TDS

Penalty for Delay: 1.5% interest per month + penalty for late filing of return

Due Date: 7th August 2025

💡 Pro Tip: File Form 26Q or 24Q (as applicable) on time to avoid notices or mismatch in Form 26AS.

✅ 2. Professional Tax (PT) – Due by 10th August 2025

What to Do: Pay PT on salaries paid in July 2025

Applies To: Employers in states like Maharashtra, Karnataka, West Bengal, etc.

Due Date: 10th August 2025

💡 Note: PT is a state-specific compliance. Make sure you’re following the respective state PT Act.

✅ 3. GSTR-1 (Monthly) – Due by 11th August 2025

What to Do: File GSTR-1 for July 2025

Applies To: Monthly GST filers

Due Date: 11th August 2025

💡 Why Important? GSTR-1 data auto-populates your buyers’ GSTR-2B. File timely to avoid input tax credit mismatch.

✅ 4. GSTR-1 IFF (QRMP) – Due by 13th August 2025

What to Do: File Invoice Furnishing Facility (IFF) for July 2025

Applies To: QRMP filers who want to upload B2B invoices monthly

Due Date: 13th August 2025 (Optional)

💡 IFF Use Case: If you’re a small business under the Quarterly Return Monthly Payment (QRMP) scheme and your B2B buyers need ITC this month, file IFF on time.

✅ 5. PF & ESI Payment – Due by 15th August 2025

What to Do: Deposit and file returns for PF & ESI contributions for July 2025

Applies To: All employers covered under EPFO and ESIC

Due Date: 15th August 2025

💡 Penalty Alert: Delays can attract interest at 12% and damages up to 25%.

✅ 6. GSTR-3B (Monthly) – Due by 20th August 2025

What to Do: File GSTR-3B for July 2025

Applies To: Monthly GST filers

Due Date: 20th August 2025

💡 Compliance Tip: Ensure GSTR-1 and GSTR-3B values match to avoid notices under Section 73 or 74 of the CGST Act.

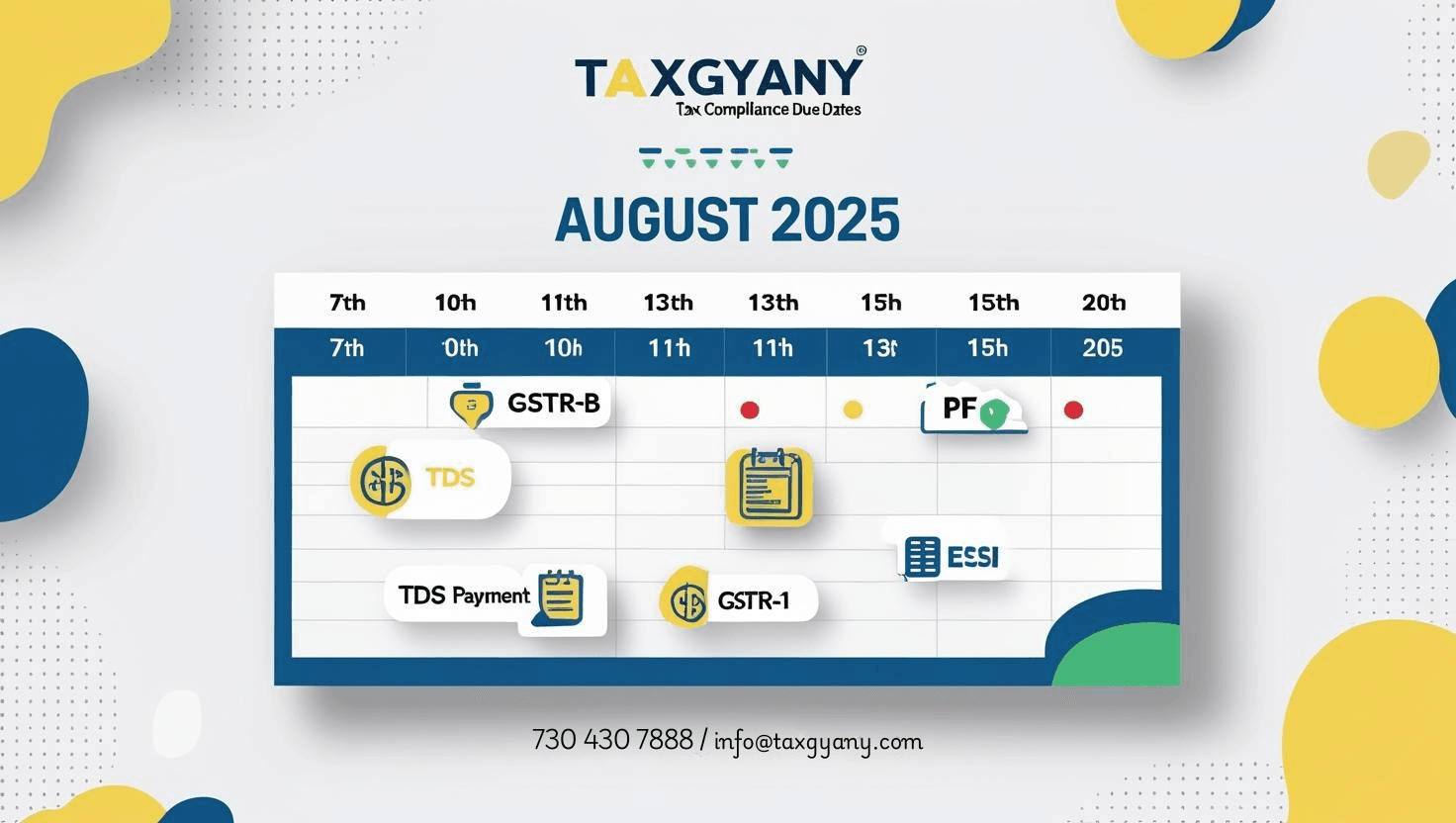

📌 Summary of August 2025 Tax Due Dates

| Compliance Type | Due Date |

|---|---|

| TDS Payment | 7 August 2025 |

| Professional Tax (PT) | 10 August 2025 |

| GSTR-1 (Monthly) | 11 August 2025 |

| GSTR-1 IFF (QRMP) | 13 August 2025 |

| PF & ESI Payment | 15 August 2025 |

| GSTR-3B (Monthly) | 20 August 2025 |

🧾 Why Compliance Calendar Matters?

Avoid late fees, penalties, and interest

Build credibility with vendors and clients

Maintain seamless cash flow and ITC availability

Stay prepared for audits and assessments

📲 Need Help with Filing?

At Taxgyany, we take the burden of due dates off your shoulders. From GST returns to TDS filing, PF/ESI payments, and tax audit prep, we’ve got you covered.

🔗 Visit Our Website

📞 Call us at 730 430 7888

📧 Email: info@taxgyany.com

💡 Bonus Tip

Bookmark this blog and set calendar reminders every month to stay ahead of your compliances. Want monthly updates like this in your inbox? Subscribe to our free newsletter!

#AugustTaxCalendar #GSTR3B #TDSDueDate #GSTReturns #PFESIDueDate #QRMP #GSTR1 #Taxgyany #TaxComplianceIndia #IncomeTax2025 #AccountingServices