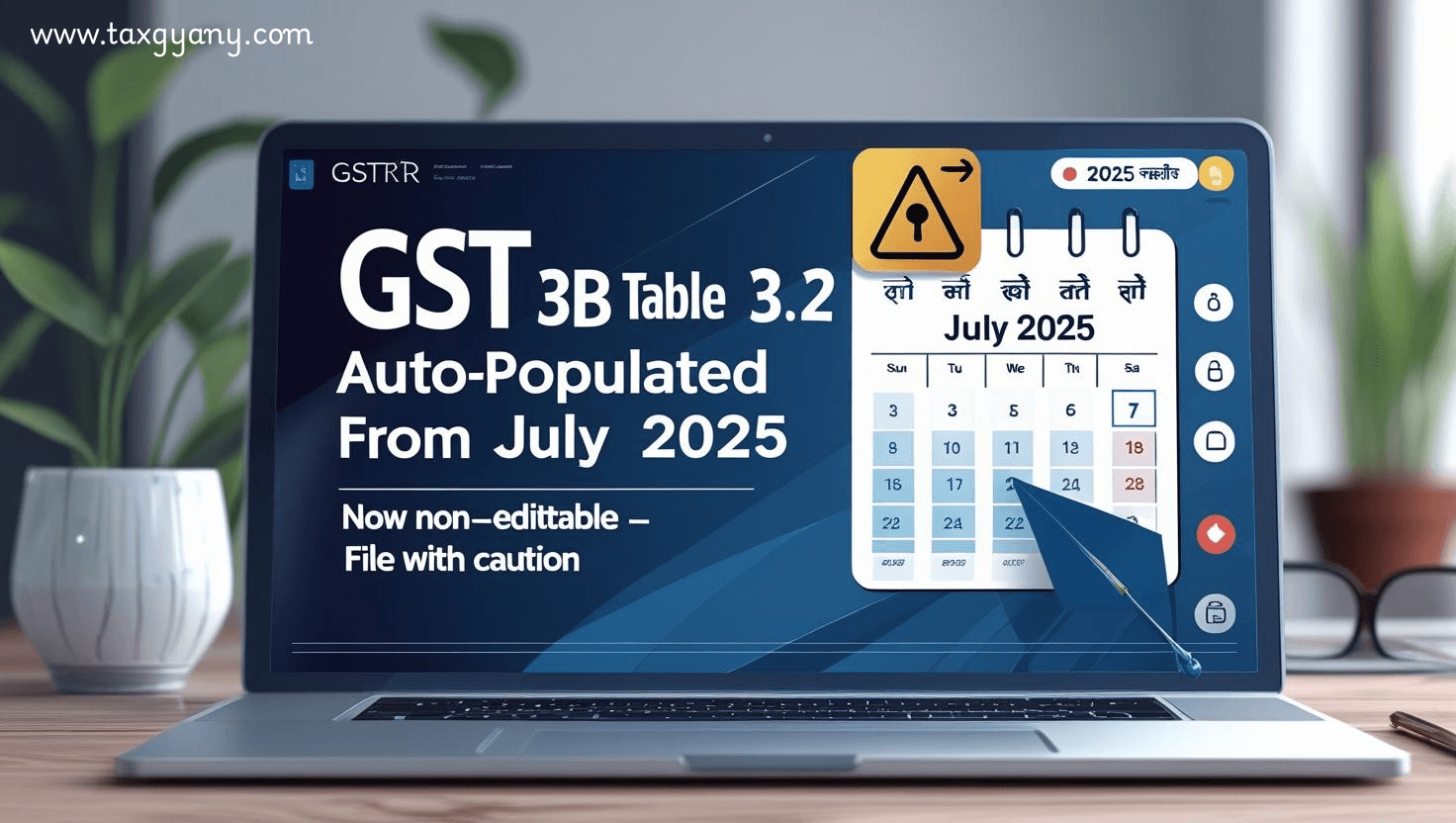

GST Update: Changes in Table 3.2 of GSTR-3B from July 2025 – What You Need to Know

The Goods and Services Tax Network (GSTN) has announced a crucial update for all regular GST taxpayers filing GSTR-3B. Starting from the July 2025 tax period, values in Table 3.2 of GSTR-3B for inter-State supplies will now be auto-populated and non-editable.