GST

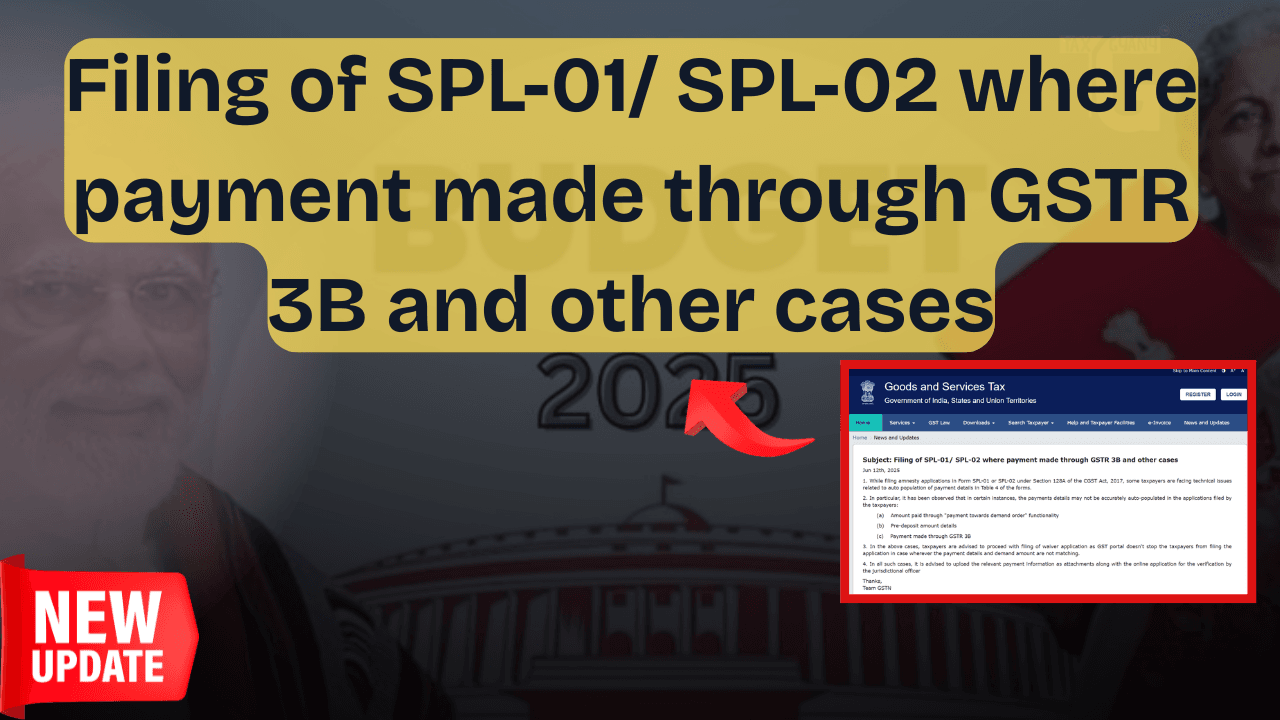

Filing of SPL-01/ SPL-02 where payment made through GSTR 3B and other cases

Don’t Let GST Filing Errors Cost You – How to Handle SPL-01/SPL-02 Filing When Payments Don’t Auto-Update Filing GST forms can be stressful – especially when technical issues pop up. If you’re a taxpayer trying to file SPL-01 or SPL-02 for amnesty under Section 128A of the CGST Act and you’re facing issues with payment … Read more