New Capital Gains Tax Rules from July 23, 2024: What You Must Know About LTCG & STCG on Securities

💼 Meet Ramesh – A Small Investor with Big Questions

Ramesh, a 32-year-old IT professional in Mumbai, has been investing in mutual funds and shares for the past few years. Recently, he sold some equity mutual funds and unlisted company shares and made a decent profit. But when he went to file his Income Tax Return for FY 2024-25, he got confused.

His usual 10% and 15% capital gains tax rates were not matching with what the new tax calculator showed. Something had changed.

Turns out — from July 23, 2024, new rules have been introduced for both Long-Term Capital Gains (LTCG) and Short-Term Capital Gains (STCG) on securities. Here’s a breakdown that can help Ramesh — and YOU — understand it clearly.

🚨 What Has Changed?

From 23rd July 2024, the government has revised:

The tax rates on LTCG and STCG

The exemption limits on listed shares

And indexation benefits on both listed and unlisted securities

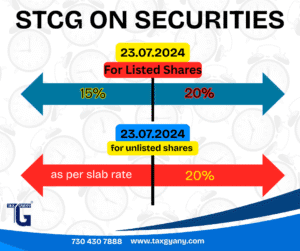

📊 Short-Term Capital Gains (STCG) – Before vs After 23 July 2024

🔹 For Listed Shares (held < 12 months):

| Period | Tax Rate |

|---|---|

| Before 23.07.2024 | 15% flat |

| After 23.07.2024 | 20% flat |

🔹 For Unlisted Shares:

| Period | Tax Rate |

|---|---|

| Before 23.07.2024 | As per income slab |

| After 23.07.2024 | 20% flat |

👉 Impact: Earlier, small traders and freelancers selling unlisted shares could pay STCG based on their tax slab. Now, it’s 20% for all.

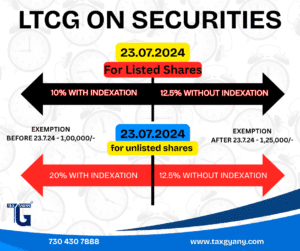

💰 Long-Term Capital Gains (LTCG) – What’s New?

🔹 For Listed Shares (held > 12 months):

| Period | Exemption Limit | Tax Rate |

|---|---|---|

| Before 23.07.2024 | ₹1,00,000 | 10% without indexation |

| After 23.07.2024 | ₹1,25,000 | 12.5% without indexation |

Note: Indexation benefit not available for listed securities.

🔹 For Unlisted Shares:

| Period | Indexation | Tax Rate |

|---|---|---|

| Before 23.07.2024 | Yes | 20% with indexation |

| After 23.07.2024 | No | 12.5% flat (without indexation) |

📌 Real Example:

Ramesh made the following gains:

₹1,80,000 LTCG from listed shares on 15 Aug 2024

₹75,000 STCG from unlisted shares on 10 Sept 2024

Tax Payable:

LTCG: ₹1,80,000 – ₹1,25,000 = ₹55,000 → Tax = ₹6,875 (12.5%)

STCG: ₹75,000 → Tax = ₹15,000 (20%)

🧾 Key Points to Remember

✅ Section 112A (LTCG Listed Shares):

Exemption increased from ₹1,00,000 to ₹1,25,000

Tax increased from 10% to 12.5%

✅ STCG on Listed Shares:

Flat 20% rate instead of 15%

✅ STCG on Unlisted Shares:

Flat 20% instead of slab rates

✅ LTCG on Unlisted Shares:

Flat 12.5% but no indexation benefit

✅ These changes apply to gains made on or after 23rd July 2024

🧠 What Should You Do Now?

✔️ Plan your trades before and after the cut-off date

✔️ Split reporting in your ITR for gains made before and after 23 July 2024

✔️ File using correct ITR form (ITR-2 or ITR-3)

✔️ Consult a tax professional for complex gains or carry-forward losses

📜 Reporting in ITR

In your ITR for AY 2025-26, ensure:

You separate capital gains before 23.07.2024 and after

Use the latest version of ITR-2 or ITR-3

Fill Schedule CG correctly

🧾 Tax Forms to Use:

ITR-2 for salaried or non-business income with capital gains

ITR-3 if you have business/profession + capital gains

✅ Moral of the Story

Ramesh learned that tax rules keep evolving — and timing your trades can make a big difference.

📢 Final Word

If equity capital gains are your only source of income, the basic exemption limit still applies. But Section 87A rebate does not. So plan wisely and don’t delay your filing.

Need help with filing or capital gains planning?

📞 Call: 730 430 7888

🌐 Visit: www.taxgyany.com