October 2025 Compliance Due Date Calendar: Important Tax Deadlines You Can’t Miss

Meet Anand, a small business owner in Mumbai. Like many entrepreneurs, Anand juggles multiple tasks daily. One day, he realized that he had missed the due date to pay TDS for September, which caused him a penalty and extra stress. Learning from his mistake, Anand now keeps a close eye on compliance due dates so that his business runs smoothly without last-minute panic.

If Anand’s story sounds familiar, here is a simple guide to the October 2025 compliance due date calendar explaining when key tax filings and payments need to be made. This guide ensures taxpayers like Anand never miss important deadlines.

Why Are Compliance Due Dates Important?

Staying ahead of tax due dates is crucial because:

Avoid penalties: Late payments and filings attract fines and interest.

Legal compliance: Timely tax payments keep your business in good legal standing.

Smooth operations: Prevent audits and legal notices by being compliant.

Peace of mind: Filing on time reduces stress and business disruptions.

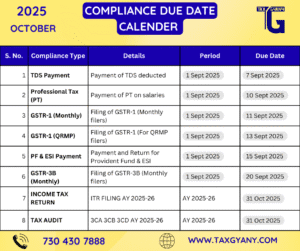

Key Compliance Deadlines in October 2025

Below is the calendar with important tax filing and payment deadlines for businesses:

| S. No. | Compliance Type | Details | Period | Due Date |

|---|---|---|---|---|

| 1 | TDS Payment | Payment of TDS deducted | 1 Sept 2025 | 7 Sept 2025 |

| 2 | Professional Tax (PT) | Payment of PT on salaries | 1 Sept 2025 | 10 Sept 2025 |

| 3 | GSTR-1 (Monthly) | Filing of GSTR-1 (Monthly filers) | 1 Sept 2025 | 11 Sept 2025 |

| 4 | GSTR-1 (QRMP) | Filing of GSTR-1 (For QRMP filers) | 1 Sept 2025 | 13 Sept 2025 |

| 5 | PF & ESI Payment | Payment and Return for Provident Fund & ESI | 1 Sept 2025 | 15 Sept 2025 |

| 6 | GSTR-3B (Monthly) | Filing of GSTR-3B (Monthly filers) | 1 Sept 2025 | 20 Sept 2025 |

| 7 | Income Tax Return | ITR Filing for Assessment Year 2025-26 | AY 2025-26 | 31 Oct 2025 |

| 8 | Tax Audit | Filing of Tax Audit Reports (3CA, 3CB, 3CD) | AY 2025-26 | 31 Oct 2025 |

Understanding these deadlines can keep your business on track and stress-free.

What Each Compliance Means for Your Business

TDS Payment: Tax Deducted at Source must be deposited timely to avoid interest and penalties.

Professional Tax: State-level tax on employees’ salaries that businesses must pay monthly.

GSTR-1: Monthly or quarterly return detailing outward supplies made by your business.

PF & ESI Payments: Employee provident fund and insurance payments to ensure worker benefits.

GSTR-3B: Summary GST return filing declaring tax liabilities and input tax credits.

Income Tax Return: Filing of annual return reflecting your income, expenses, and tax calculation.

Tax Audit Returns: Audit reports required for businesses exceeding prescribed turnover limits.

Tips to Stay Compliant

Maintain a compliance calendar synced with reminders.

Use accounting software to track dues and filings.

Hire or consult with tax professionals like Taxgyany to manage compliances.

Regularly reconcile accounts and statutory records.

File returns and deposits before due dates to avoid last-minute rush.

How Taxgyany Can Help You

At Taxgyany, we understand the stress of tax compliances. Our team assists in timely filing of TDS, GST returns, PF & ESI payments, income tax returns, and tax audits. By partnering with us, you get professional support, accurate filings, and peace of mind.

Contact us today:

📞 7304307888

🌐 www.taxgyany.com

Conclusion

Anand’s experience shows that missing tax deadlines can be costly, but it is avoidable. Planning ahead and knowing your compliance due dates for October 2025 can help your business thrive without worries. Use this calendar as your guide, and if you want expert help, Taxgyany is here to make tax filing effortless and accurate.

Moral of the Story

Being proactive about your tax deadlines is the key to a successful and stress-free business journey.