Tax Audit for Business Owners: Understanding 44AB vs 44AD Made Simple

Ramesh is a 35-year-old businessman from Jaipur who runs a small electronics shop. Every year, he struggles with income tax filing

He had to run around, fix it at the last minute, and barely submitted his return in time. But this year, things got more confusing. His CA asked him, “Are you eligible for presumptive taxation under 44AD or is tax audit required under 44AB?”

Ramesh scratched his head. “What’s the difference? Why does it matter?”

If you’re in Ramesh’s shoes and want a clear, no-jargon explanation of Sections 44AB and 44AD, this blog is for you.

Why You Should Understand 44AB vs 44AD

If you’re a business owner, you’ve probably heard these terms during tax season. These sections deal with:

When a tax audit is required

Who can opt for presumptive taxation

What conditions must be met

Knowing which section applies to you can save time, avoid penalties, and help with smooth ITR filing.

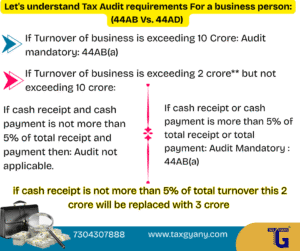

Let’s Decode Tax Audit with Simple Rules

Here’s a simplified way to understand when tax audit is required under Section 44AB, and when presumptive taxation under Section 44AD can be used.

🔹 Case 1: Turnover More Than ₹10 Crore

If your business turnover exceeds ₹10 crore, tax audit is mandatory.

You must get your accounts audited by a Chartered Accountant under Section 44AB(a).

✅ Audit Required

❌ Presumptive taxation not allowed

🔹 Case 2: Turnover Between ₹2 Crore and ₹10 Crore

This is where things get interesting.

Scenario A: Cash receipts and payments less than or equal to 5%

Audit is not required

But you cannot opt for presumptive taxation under 44AD

This applies if:

Cash receipts ≤ 5% of total receipts

Cash payments ≤ 5% of total payments

Scenario B: Cash receipts or payments more than 5%

Tax audit is mandatory under 44AB(a)

📝 Note:

If your cash receipts are within 5%, the ₹2 crore limit increases to ₹3 crore for presumptive taxation eligibility.

🔹 Case 3: Turnover Less Than or Equal to ₹2 Crore

You may be eligible for presumptive taxation under Section 44AD, but conditions apply.

Scenario A: Last year you opted for 44AD

You must continue declaring income at 8% (non-digital) or 6% (digital)

If you want to declare lower income, tax audit is mandatory only if your total income exceeds the basic exemption limit

Once you opt out of 44AD, you can’t opt back in for the next 5 years

Scenario B: You didn’t opt for 44AD last year

You can choose to not follow 44AD this year too

Then your case will be handled as per Point 2 above (i.e., check cash usage and turnover)

📝 Note:

If it’s your first year of business, you’re free to choose. Even if you declare less than 6/8%, audit is not mandatory, unless your turnover exceeds ₹1/2/3 crore as per cash criteria.

Quick Summary Table

| Turnover | Cash Usage | Audit Required? | 44AD Allowed? |

|---|---|---|---|

| Above ₹10 crore | Any | Yes – 44AB(a) | No |

| ₹2–₹10 crore | ≤ 5% | No | No |

| ₹2–₹10 crore | > 5% | Yes – 44AB(a) | No |

| ≤ ₹2 crore + used 44AD before | NA | Yes, if income < 8/6% + exceeds exemption | Yes |

| ≤ ₹2 crore, first time filer | NA | No, unless turnover exceeds limits | Optional |

Moral of Ramesh’s Story

Ramesh finally understood the logic:

His turnover was ₹1.8 crore

He had used 44AD last year

This year, he wanted to declare less than 6%

So, he got his books audited and learned that planning ahead avoids stress later.

Conclusion: Know Your Section, Avoid Confusion

The Income Tax Act provides flexibility through Section 44AD and discipline through Section 44AB. But it’s important to:

✅ Understand your turnover range

✅ Check your cash usage

✅ Track whether you used 44AD last year

✅ Consult a tax expert before filing

Key Takeaways:

Turnover above ₹10 crore? Audit is mandatory.

Turnover between ₹2–₹10 crore? Check if cash is under 5%.

Turnover below ₹2 crore? 44AD can be used, but with conditions.

Used 44AD last year? You’re expected to continue unless you’re ready for audit.

44AD, once skipped, can’t be used again for 5 years.

Stay informed. File smart. Don’t be like old Ramesh—be the new, updated version.