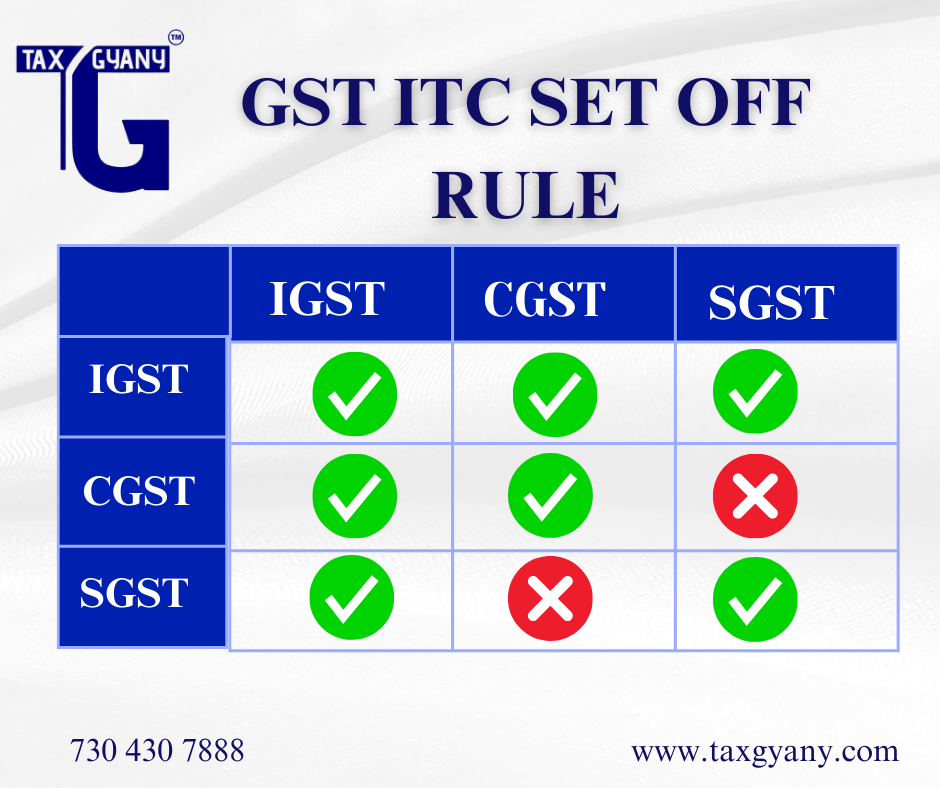

Guide For GST ITC Setoff Rules

Introduction: GST ITC Setoff Rules Navigating the labyrinth of Tax regulations can be daunting, especially when it comes to the intricate setoff rules of the Goods and Services Tax (GST). Understanding the nuances of GST setoff is essential for businesses and individuals alike to optimise tax liabilities and ensure compliance with regulatory requirements. In this … Read more